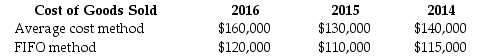

Machino,Inc.began operations on January 1,2014.During 2016,management decided to change from average-cost method to FIFO for its merchandise inventories.The change was effective at January 1,2016.Management determined that cost of goods sold for each method would be:

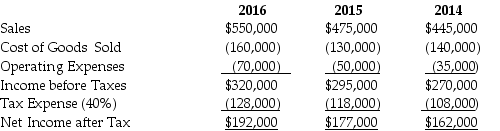

The company's statements as reported under average-cost before implementing the accounting change for 2016,2015,and 2014,respectively,are presented below.The income tax rate for Machino is 40%.

The company's statements as reported under average-cost before implementing the accounting change for 2016,2015,and 2014,respectively,are presented below.The income tax rate for Machino is 40%.

Required:

Required:

Definitions:

Consequences

The outcomes or effects that result from a particular action or condition.

Economic Injury

Financial harm or damage suffered by an individual, entity, or economy, often due to external factors or actions.

Intentional Tort

A wrongful act done on purpose that causes harm to someone else, including acts like assault or fraud.

Physical Injury

Bodily harm or damage to a person's body, as opposed to emotional or psychological harm.

Q36: A chart of accounts is a<br>A)subsidiary ledger.<br>B)listing

Q59: TNT Corporation's income tax payable is $210,000

Q69: The overall objective of financial reporting is

Q73: Cash paid for merchandise is calculated as

Q86: McManus Inc.reported net earnings of $400,000 for

Q109: Greene Co.reported a loss in 2015 of

Q112: Refer to Bosworth Corporation.What will be the

Q133: Accounting changes are only permitted when _.<br>A)the

Q213: When a large corporation purchases a new

Q245: Typically,the lessee will pay for executory costs,expensing