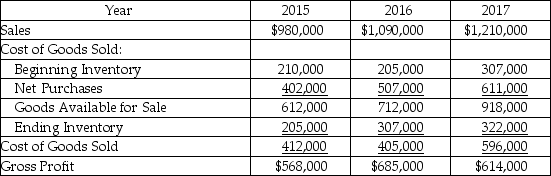

Vieta,Inc.'s CFO discovered a program error in its inventory program in early 2018,when she was making year-end adjustments to the financial statements for 2017.The errors began in 2015.Below is a summary of the sales and cost of goods sold on income statement items for the three years:

Upon further analysis,the CFO determined that each of the years had ending inventory errors.The correct amounts for the years were: 2015,$231,000; 2016,$350,000; and 2017,$474,000.The amounts for 2015 beginning inventory and all purchases are correct as stated.

Upon further analysis,the CFO determined that each of the years had ending inventory errors.The correct amounts for the years were: 2015,$231,000; 2016,$350,000; and 2017,$474,000.The amounts for 2015 beginning inventory and all purchases are correct as stated.

Required:

Definitions:

Rabies

A viral disease that causes inflammation of the brain in humans and other mammals, typically transmitted through the bite of an infected animal.

Carriers

Individuals or organisms that harbor a disease-causing organism but do not show symptoms, potentially transmitting the disease to others.

Raccoons

North American mammals known for their distinctive black "mask" of fur around their eyes and their highly dexterous front paws.

Tetanus Toxoid

A vaccine used to provide immunity against tetanus, a bacterial infection.

Q4: Identify and explain the steps in U.S.GAAP's

Q23: Cougar,Inc.,an IFRS reporter,estimates a deferred tax asset

Q23: Under a defined contribution pension plan,the contribution

Q24: When there are multiple dilutive securities in

Q30: A company can choose the fair value

Q41: In an accrual accounting system,<br>A)all accounts have

Q77: When financial reports from two different companies

Q112: Refer to Violet Corporation.Violet reported taxable income

Q196: The cost of a leasehold improvement is

Q225: On January 1 of the current year,Fields