On January 1 of the current year,Stephens Corporation leased machinery from Montgomery Company.The machine originally cost Montgomery $250,000.The lease agreement is an operating lease,the terms of which call for five annual payments of 25,000.The first payment is due at the inception of the lease; the other three payments are due on January 1 of subsequent years.What journal entry should Stephens make on January 1 of the current year?

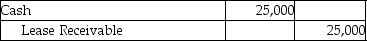

A)

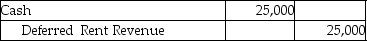

B)

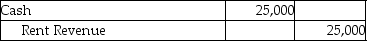

C)

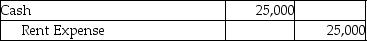

D)

Definitions:

Security Market Line

A graphical representation of the expected return of investments as a function of their risk, depicting the relationship between the risk and the expected return of the market.

Fairly Priced

A term indicating that an asset's selling price is considered to be in line with its intrinsic value.

Homogeneous Expectations

An assumption in finance that all investors have the same expectations regarding the future rates of return, volatilities, and correlations of securities.

Economic View

A perspective or analysis based on economic indicators, trends, and policies to understand or predict economic outcomes.

Q6: A gain on the sale of a

Q21: Changes in accounting principles generally are reported

Q26: Helena Co.began operations on January 1,2014,with $100,000

Q32: US GAAP assumes that all potential shares

Q66: Sonar Company prepared a draft of its

Q66: The United States Securities and Exchange Commission<br>A)has

Q92: The conceptual model for the statement of

Q107: When a material seven-year depreciable asset is

Q168: How do the total expenses over the

Q283: For each of the following situations,determine the