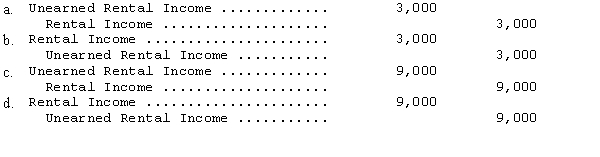

L.Lane received $12,000 from a tenant on December 1 for four months' rent of an office.This rent was for December,January,February,and March.If Lane debited Cash and credited Unearned Rental Income for $12,000 on December 1,what necessary adjustment would be made on December 31?

Definitions:

Q3: Under some circumstances,the lessee does not record

Q13: The harmonization of world accounting standards is

Q34: Bank overdrafts are considered to be a

Q56: The following changes in American Corporation's account

Q74: Hondo Co.has total debt of $252,000 and

Q92: The conceptual model for the statement of

Q99: The information listed below was obtained from

Q231: If a lease transaction is in essence

Q294: u.S.GAAP and IFRS accounting is the same

Q295: For a lessor to classify a lease