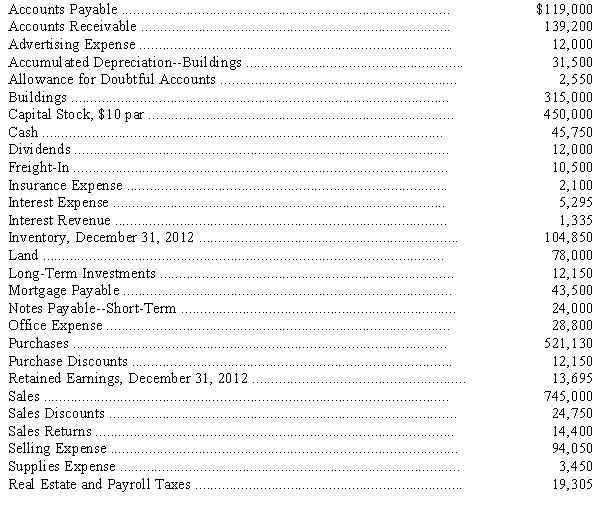

Account balances taken from the ledger of Middler Company on December 31,2013,are as follows:

Adjustments on December 31,2013,are required as follows:

(a)The inventory on hand is $135,915.

(b)The allowance for doubtful accounts is to be increased to a balance of $6,250.

(c)Buildings are depreciated at the rate of 5 percent per year.

(d)Accrued selling expenses are $6,075.

(e)There are supplies of $1,050 on hand.

(f)Prepaid insurance at December 31,2013,totals $1,290.

(g)Accrued interest on long-term investments is $360.

(h)Accrued real estate and payroll taxes are $1,170.

(i)Accrued interest on the mortgage is $240.

(j)Income tax is estimated to be 30 percent of the income before income tax (round to nearest dollar).

(1)Prepare an eight-column work sheet.

(2)Prepare adjusting and closing entries.

Definitions:

Foreigners

Individuals or entities from one country who are living in, conducting business, or present in another country.

Assets

Resources owned by an individual or business that have value and can be used to meet debts, commitments, or legacies.

Net Creditor Nation

A country that has lent more money to other countries than it has borrowed from them.

Leading

Often refers to economic indicators that predict or signal future movements in the economy or stock market before they occur.

Q6: A classic definition of income states that

Q14: One of the four factors that motivate

Q22: The practice of carefully timing the recognition

Q31: The accrual basis of accounting is based

Q37: The following data were taken from the

Q47: Receivables can be used to generate cash

Q50: A company sold 10,000 shares of its

Q55: The responsibility of the Emerging Issues Task

Q64: Stratosphere Manufacturing Company sold plant assets at

Q134: Under generally accepted accounting principles,the lower-of-cost-or-market procedure