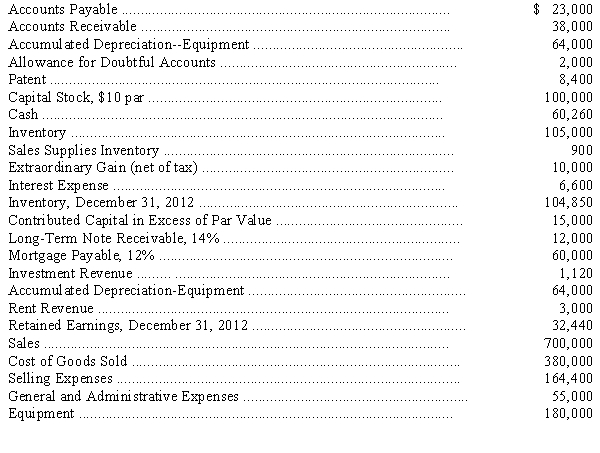

Account balances taken from the ledger of Owens Company on December 31,2013,are as follows:

Adjustments on December 31,2013,are required as follows:

(a)Estimated bad debt loss rate is 1/4 percent of credit sales.Credit sales for the year amounted to $200,000.Classify bad debt expense as a selling expense.

(b)Interest on the long-term note receivable was last collected August 31,2013.

(c)Estimated life of the equipment is 10 years,with a residual value of $20,000.Allocate 10 percent of depreciation expense to general and administrative expense and the remainder to selling expenses.Use straight-line depreciation.

(d)Estimated economic life of the patent is 14 years (from January 1,2013)with no residual value.Straight-line amortization is used.Depreciation expense is classified as selling expense.

(e)Interest on the mortgage payable was last paid on November 30,2013.

(f)On June 1,2013,the company rented some office space to a tenant for one year and collected $3,000 rent in advance for the year; the entire amount was credited to rent revenue on this date.

(g)On December 31,2013,the company received a statement for calendar year 2013 property taxes amounting to $1,300.The payment is due February 15,2014.Assume that the payment will be made on February 15,2014,and classify expense as selling expense.

(h)Sales supplies on hand at December 31,2013,amounted to $300; classify as selling expense.

(i)Assume an average income tax rate of 40 percent corporate tax rate on all items including the extraordinary gain..

(1)Prepare an eight-column work sheet.

(2)Prepare adjusting and closing entries.

Definitions:

Substitute Goods

Products or services that can be used in place of each other, having a positive cross-elasticity of demand.

Productive Efficiency

A situation in which a good or service is produced at the lowest possible cost.

Quantity of Goods

The total number of physical units of a product or commodity that are available in the market.

Desired by Society

Pertains to something that is widely regarded as beneficial or needed by the majority of the community or population.

Q2: In preparing its bank reconciliation for the

Q4: Which of the following statements best describes

Q11: Which of the following items is reported

Q18: The following balances have been excerpted from

Q27: Stanner Company's 2014 income statement reported cost

Q61: The books of Barry's Service,Inc.disclosed a cash

Q64: Which of the following statements regarding assets

Q88: Users require a variety of information about

Q116: Changes in which of the following are

Q359: How is an unguaranteed residual value accounted