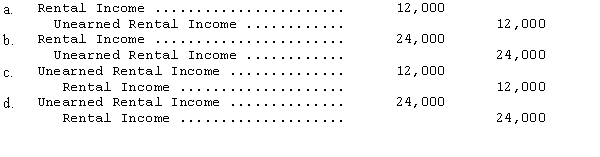

Thompson Company sublet a portion of its office space for ten years at an annual rental of $36,000,beginning on May 1.The tenant is required to pay one year's rent in advance,which Thompson recorded as a credit to Rental Income.Thompson reports on a calendar-year basis.The adjustment on December 31 of the first year should be

Definitions:

IFRS

International Financial Reporting Standards, which are a set of accounting standards developed by the International Accounting Standards Board (IASB) for global use in financial reporting.

ASPE

The Accounting Standards for Private Enterprises (ASPE) is a set of accounting standards for private companies in Canada, providing guidelines on financial reporting practices.

Accrual Basis

An accounting method where revenues are recorded when earned, and expenses are recorded when incurred, regardless of when cash is exchanged.

Net Income

The net income of a business once all costs and taxes are subtracted from its total earnings.

Q6: Carbon Company's accounting records provided the following

Q17: Which of the following is true about

Q24: For a direct-finance capital lease,the lease receivable

Q27: Stanton Industrial sells machinery on the installment

Q33: A significant part of the compensation received

Q56: In 2017,BayKing Company sold used equipment for

Q79: Which of the following is true?<br>The results

Q141: Which of the following is not a

Q278: Firms report cash flows from investing activities

Q366: The indirect method of calculating cash flows