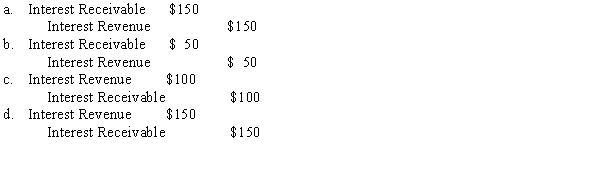

A company loaned $6,000 to another corporation on December 1,Year 1,and received a 90-day,10 percent,interest-bearing note with a face value of $6,000.The lender's December 31,Year 1,adjusting entry is

Definitions:

Medical Insurance

A type of insurance coverage that pays for an individual's medical and surgical expenses incurred from illness or injury, or reimburses the insured for expenses incurred from such incidents.

Unemployment Taxes

Taxes imposed on employers, based on the amount of wages paid to employees, used to fund unemployment compensation programs.

Gross Wages

The total amount of salary or wages earned by an employee before any deductions or taxes are applied.

Social Security

A governmental program providing financial assistance to people with inadequate or no income, especially the elderly, disabled, and families with dependent children.

Q8: In preparing the bank reconciliation of Yardley

Q17: Which of the following is true about

Q20: The _ of a firm is primarily

Q56: The amortization of a bond premium can

Q66: Under U.S.GAAP,bank overdrafts are typically considered to

Q88: On January 1,2014 Flora Enterprises obtained a

Q163: Which of the following is not an

Q171: In determining the present value of the

Q269: If a lessee makes prepayments on an

Q340: The party acquiring the use of a