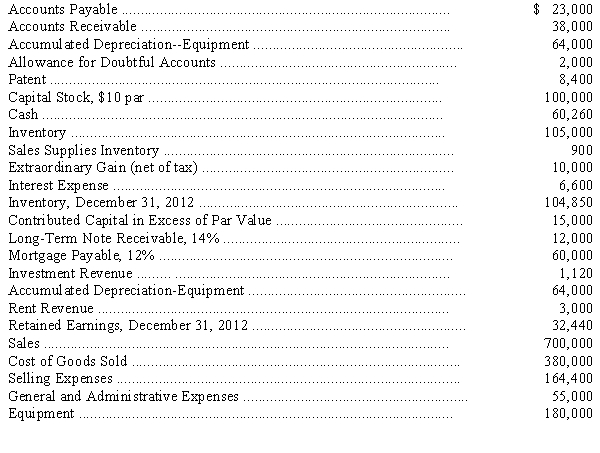

Account balances taken from the ledger of Owens Company on December 31,2013,are as follows:

Adjustments on December 31,2013,are required as follows:

(a)Estimated bad debt loss rate is 1/4 percent of credit sales.Credit sales for the year amounted to $200,000.Classify bad debt expense as a selling expense.

(b)Interest on the long-term note receivable was last collected August 31,2013.

(c)Estimated life of the equipment is 10 years,with a residual value of $20,000.Allocate 10 percent of depreciation expense to general and administrative expense and the remainder to selling expenses.Use straight-line depreciation.

(d)Estimated economic life of the patent is 14 years (from January 1,2013)with no residual value.Straight-line amortization is used.Depreciation expense is classified as selling expense.

(e)Interest on the mortgage payable was last paid on November 30,2013.

(f)On June 1,2013,the company rented some office space to a tenant for one year and collected $3,000 rent in advance for the year; the entire amount was credited to rent revenue on this date.

(g)On December 31,2013,the company received a statement for calendar year 2013 property taxes amounting to $1,300.The payment is due February 15,2014.Assume that the payment will be made on February 15,2014,and classify expense as selling expense.

(h)Sales supplies on hand at December 31,2013,amounted to $300; classify as selling expense.

(i)Assume an average income tax rate of 40 percent corporate tax rate on all items including the extraordinary gain..

(1)Prepare an eight-column work sheet.

(2)Prepare adjusting and closing entries.

Definitions:

Gatekeeper

An individual or entity that controls access to something, often determining whether a message or piece of information is disseminated.

Public Relations

The professional practice of managing and shaping the public perception of an organization, individual, or brand through strategic communication.

Employee Communications

The process of effectively sharing information and engaging with employees within an organization.

Advertising

The activity or profession of producing advertisements for commercial products or services.

Q11: The International Accounting Standards Board was formed

Q14: When the FASB deliberates about an accounting

Q16: The GAAP Oval best represents the<br>A)fact that

Q20: The direct method of formatting the statement

Q26: Helena Co.began operations on January 1,2014,with $100,000

Q31: In a statement of cash flows,proceeds from

Q40: In 2011,Huxley Corp.began construction work under a

Q40: Partial balance sheet data and additional information

Q41: In preparing a monthly bank reconciliation,which of

Q250: Horton Industries reported net income of $150,000