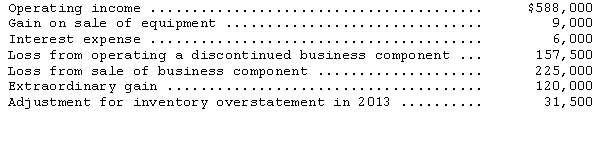

Panther Corp.reported the following pretax amounts for the year ending December 31,2014:

The income tax rate applicable to Panther is 30 percent.Prepare a partial income statement for the year ending December 31,2014,beginning with "Income from continuing operations before income taxes." Include the presentation of earnings per share,assuming 50,000 shares were outstanding during the year.

Definitions:

Emotional Intensity

The degree of strength or depth of feeling associated with an emotion or emotional response.

Conflict Resolution

The process of resolving a dispute or disagreement, aiming to reach an agreement that satisfies all parties involved.

Emotions Managed

The process of regulating and controlling one's emotional responses to maintain harmony in interactions or achieve goals.

Emotions Destructive

Involves feelings that are negative in nature and have the potential to cause harm or deteriorate relationships, such as anger, jealousy, or hatred.

Q15: The financial statements that are prepared for

Q23: Which of the following items would be

Q43: The Governmental Accounting Standards Board<br>A)was incorporated into

Q44: Which of the following typically involves the

Q45: Internal earnings targets represent an important tool

Q54: In November and December 2013,Bee Company,a newly

Q71: When the direct write-off method of recognizing

Q174: How is net income adjusted for pension

Q244: Under IFRS,the lessee must used the lessee's

Q374: Refer to Crest Industries:<br>1.Prepare an amortization schedule