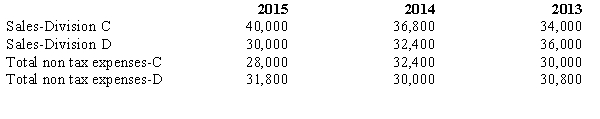

Amityville Company has two divisions,C and D.The operations and cash flows of these two divisions are clearly distinguishable.On July 1,2015,the company decided to dispose of the assets and liabilities of Division D.It is probable that the disposal will be completed early next year.The revenues and expenses of Amityville Company for 2015 and for the preceding two years are as follows:

During the latter part of 2015,Amityville disposed of a portion of Division D and recognized a pretax loss of $10,000 on the disposal.The income tax rate for Amityville Company is 40%.

Prepare the comparative income statements for Amityville Company for the years 2013,2014,and 2015.

Definitions:

Internal Bleed

Bleeding within the body that is not visible from the outside, often a serious medical condition requiring immediate attention.

Systolic Blood Pressure

The pressure in the arteries when the heart beats and fills them with blood, the first number in a blood pressure reading.

Reflection

The process of introspection, contemplating one’s thoughts and feelings, or the examination of a past event.

Nonverbal Behavior

Communication methods other than spoken or written language, such as gestures, facial expressions, and posture.

Q21: Which of the following is not true

Q31: In a statement of cash flows,proceeds from

Q60: On August 1,a firm assigned $30,000 of

Q65: A single-step income statement is a format

Q69: The overall objective of financial reporting is

Q81: An expenditure subsequent to acquisition of assembly-line

Q118: A lessor reports rental revenue if it

Q238: When there is a bargain purchase option,the

Q322: To be classified as a capital lease,a

Q324: Refer to Superbyte Corporation.<br>Laguna Madre Company would