A review of the financial records of Stonehenge,Inc.for the current year revealed the following information:

(a)Reported interest expense of $36,000.The Interest Payable balance decreased $4,000.

(b)Declared and paid cash dividends of $175,000.

(c)Purchased a $400,000 building with a $220,000 long-term mortgage note.The remainder was paid in cash.

(d)Issued bonds with a $600,000 par value to retire 6,000 shares of $100 par value preferred stock.

(e)Held-to-maturity securities with a book value of $7,600 were sold for $9,000 during the year.

(f)Reported income tax expense of $55,000.The Income Taxes Payable balance increased $15,000.

(g)The Accounts Payable balance increased $7,740.

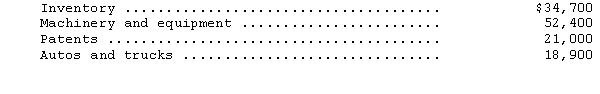

(h)Cash of $127,000 was paid to purchase business assets consisting of:

(i)Sold equipment with a net book value of $95,000 for $99,700.

(j)Issued $75,000 in common stock to acquire land with a selling price of $120,000.The difference was paid in cash.

Explain how each of the preceding items is presented in the cash flow statement,indirect method,or disclosed in the financial statements of Stonehenge,Inc.Indicate "not included" for any item that would not be reported or disclosed.Evaluate each item separately.

Definitions:

P/E Ratio

Price-to-Earnings Ratio, a valuation metric for evaluating the relative attractiveness of a company's share price compared to its earnings per share.

ROE

Return on Equity; a measure of financial performance calculated by dividing net income by shareholders' equity.

Debt-To-Equity Ratio

A financial metric that shows the comparative amount of equity and debt a company utilizes to fund its assets.

Financial Statements

Financial statements are formal records of the financial activities and position of a business, person, or other entity, typically comprising the balance sheet, income statement, and cash flow statement.

Q2: What accounting concept justifies the use of

Q26: Research has shown that numerous companies manage

Q31: The work sheet of PSI Company shows

Q46: Citrus Inc.declared and paid cash dividends of

Q49: A construction company uses the percentage-of-completion method

Q49: Analysis of a firm's balance sheet provides

Q62: The following is NOT a major component

Q66: In a statement of cash flows (indirect

Q82: Which of the following principles best describes

Q86: Financial information exhibits the characteristic of consistency