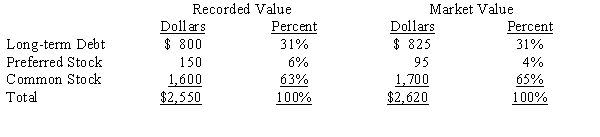

The following summarized information is available for Eastern Valley Company at December 31 of the current year:

The debt of Eastern Valley has a before-tax cost rate of 11.5%,preferred stock has a cost of 12.1%,and common equity has a cost of 14.2%.The tax rate for Eastern Valley is 34%.

Calculate the weighted average cost of capital for Eastern Valley at December 31 of the current year.

Definitions:

Bad Debts Expense

The cost associated with accounts receivable that are not expected to be collected.

Contra Asset

An asset account where its balance is opposite of the normal balance, used to offset the balance of a related account, such as allowance for doubtful accounts offsetting accounts receivable.

Expense

An outflow of money to another person or company to pay for an item or service, or for a cost required to operate a business.

Allowance for Doubtful Accounts

A contra-asset account that estimates the portion of accounts receivable which may not be collectible.

Q1: Which of the following would be subtracted

Q9: The following information was taken from the

Q22: The following information is available from the

Q36: When would the replacement cost of inventory

Q38: During 2014,Brent Industries,Inc.constructed a new manufacturing facility

Q41: Which of the following is NOT an

Q60: Unearned rent would normally appear on the

Q67: Arid Company paid $1,704 on June 1,2013,for

Q76: Silken Corp.reported net income of $420,000 for

Q89: Iowa Cattle Company uses a periodic inventory