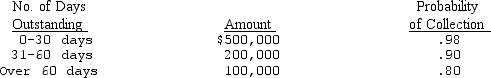

Teeming Company uses the allowance method of accounting for bad debts.The following summary schedule was prepared from an aging of accounts receivable outstanding on December 31 of the current year.

The following additional information is available for the current year:

The following additional information is available for the current year:

-See Teeming Company information above.If Teeming determines bad debt expense using 1.5 percent of net credit sales,the net realizable value of accounts receivable on the December 31 balance sheet will be

Definitions:

Credit Card Sales

Transactions in which customers use credit cards to pay for goods or services, creating a receivable for the seller until payment is processed by the card issuer.

Summary Journal Entry

A consolidated record that summarizes multiple transactions into a single entry within the accounting records.

Accounts Receivable

Money owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

Sales Returns

Transactions where customers return previously purchased merchandise, leading to a reduction in sales revenue.

Q10: An example of a nominal account would

Q18: Song Company started construction on a building

Q22: The practice of carefully timing the recognition

Q41: Volta Electronics Inc.reported the following items on

Q43: The Governmental Accounting Standards Board<br>A)was incorporated into

Q52: The percentage-of-completion method is used to recognize

Q63: Which of the following is NOT a

Q75: See information regarding the four products above.Using

Q82: The impairment test for an intangible asset

Q106: See information for Paper Depot above.If Paper