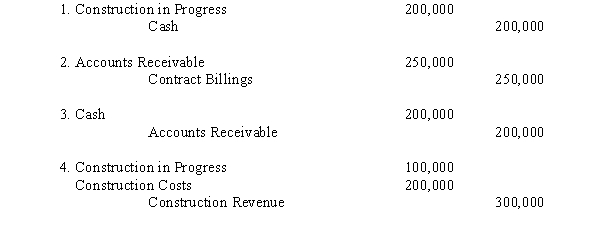

Soborne Construction,Inc.,is constructing a building for another company.Construction on the building began in 2014 and is expected to be complete in 2015.The fixed contract price was $1,500,000.During 2014,the company made the following entries:

Required:

Briefly explain the 2014 entries and why they occurred.Show the calculations and include in your explanations the nature of and the reporting of the Contract Billings account.

Definitions:

Social Security Tax

A tax levied on both employers and employees to fund the Social Security program, which provides retirement, disability, and survivorship benefits.

Gross Salary

The total amount of an employee's earnings before any deductions are made, such as taxes and social security contributions.

Insurance

A financial product that provides protection against financial loss, offering compensation in the case of specific events such as accident, illness, or damage to property.

Hostile Work Environment

A form of workplace harassment characterized by an environment that is intimidating, hostile, or offensive, making it difficult for an employee to work.

Q29: On July 1,Toucan Corporation,a calendar-year company,received a

Q31: Funnies-R-Us,Inc.committed to sell its comic book division

Q32: Which of the following is NOT required

Q32: Diamond,Inc.purchased a machine under a deferred payment

Q36: The issuance price of a bond does

Q38: Unlike a stock split,a stock dividend requires

Q49: A construction company uses the percentage-of-completion method

Q64: Which of the following factors are used

Q67: The following information was available from the

Q74: The stockholders' equity section of Sliver Corporation's