The 2014 annual report of Arrowhead Manufacturing Company contained the following notes to the company's financial statements:

Inventory Valuation

The company uses the last-in,first-out (LIFO)cost method of inventory valuation for most domestic manufacturing inventories.Other manufacturing inventories are valued at the lower of standard costs (which approximate average costs),average costs,or market.

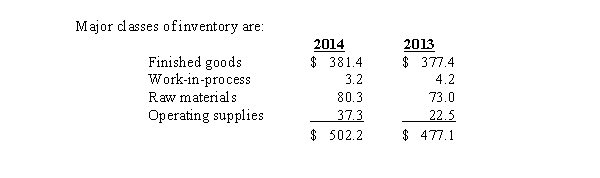

Inventories

If inventories valued on the LIFO basis had been valued at standard or average costs,which approximate current costs,consolidated inventories would be higher than reported by $21.0 million and $19.6 million at December 31,2014,and 2013,respectively.

Inventories that are valued at the lower of standard costs (which approximate average costs),average costs,or market at December 31,2014 and 2013,were approximately $185.2 million and $125.7 million,respectively.

Required:

1.Why does Arrowhead use LIFO only for domestic inventories?

2.What would have been the effect on the Arrowhead 2014 net income if the company had consistently used standard or average costs to value its inventories over time (assume a 34% tax rate)?

3.What would be the effect on retained earnings as of December 31,2014,if Arrowhead had consistently used standard or averages to value its inventories over time?

Definitions:

Ethnic Groups

Categories of people who identify with each other based on common ancestral, social, cultural, or national experiences.

Transferred

Moved from one place, person, or thing to another.

HIV

Human Immunodeficiency Virus, a virus that attacks the immune system and can lead to AIDS if not treated.

Child

A young human being below the age of puberty or below the legal age of majority.

Q4: Lennor Company sold inventory to Myers Incorporated

Q5: Stellar Inc.carries Product A in inventory on

Q32: Freddy,Inc.had outstanding 10 percent,$1,000,000 face value,convertible bonds

Q35: A company that changes from the declining-balance

Q50: A credit balance in the account Market

Q56: Eastern Company sells products covered by a

Q68: On July 1,2014,Saunter issued 2,000 of its

Q73: Samuels Company began operations on January 1,2014,and

Q74: Astro Incorporated's financial statements for the years

Q83: The third year of a construction project