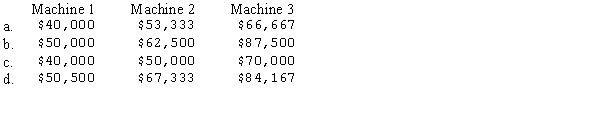

Osborne Company acquired three machines for $200,000 in a package deal.The three assets together had a book value of $160,000 on the seller's books.An appraisal costing the purchaser $2,000 indicated that the three machines had the following market values (book values are given in parentheses):

Machine 1: $60,000 ($40,000)Machine 2: $80,000 ($50,000)Machine 3: $100,000 ($70,000)The three assets should be individually recorded at a cost of (rounded to the nearest dollar)

Definitions:

Q1: When bonds are retired prior to maturity

Q26: In accordance with generally accepted accounting principles,which

Q36: Five years ago,Monroe,Inc.,purchased a patent for $110,000.Lower

Q36: According to the most current FASB standards,intangible

Q59: McCabe Institute leased a new machine having

Q62: The following information is available for Longview

Q62: When bonds are sold between interest dates,any

Q82: Which of the following principles best describes

Q96: Ominous Studios,in an effort to promote the

Q134: Under generally accepted accounting principles,the lower-of-cost-or-market procedure