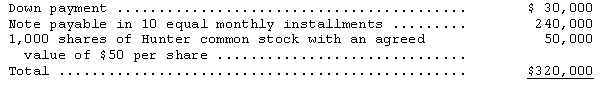

In January,Fanning Corporation entered into a contract to acquire a new machine for its factory.The machine,which had a cash price of $400,000,was paid for as follows:

Prior to the machine's use,installation costs of $10,000 were incurred.The machine has an estimated useful life of ten years and an estimated salvage value of $10,000.What should Hunter record as depreciation expense for the first year under the straight-line method?

Definitions:

Printz v. United States

A United States Supreme Court case that decided it was unconstitutional for the federal government to command states' law enforcement officers to enforce federal laws.

Gibbons v. Ogden

A landmark 1824 U.S. Supreme Court case that ruled the power to regulate interstate commerce was granted to Congress by the Commerce Clause of the Constitution.

Interstate Commerce

The exchange, movement, or transfer of goods and services across state lines within the United States.

National Government Supremacy

The principle that the federal or national government has predominant power and authority over regional or state governments, especially in legislative matters.

Q5: If a company constructs a laboratory building

Q18: An example of a "deductible temporary difference"

Q27: If an investment in stock is reclassified

Q42: Celestion should account for this lease as<br>A)an

Q51: Assume the percentage-of-completion method of revenue recognition

Q55: See Abe Company information above.What was the

Q60: What is the maximum amount at which

Q62: When the percentage-of-completion method of accounting for

Q64: In 2014,Quito Inc.purchased stock as follows:<br>(a)Acquired 2,000

Q121: Assume that a company records purchases net