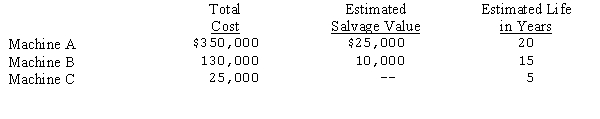

At the start of its business,Londres Corp.decided to use the composite method of depreciation and prepared the following schedule of machinery owned.

Londres computes depreciation on the straight-line method.Based on the information presented,the composite life of these assets (in years) should be

Definitions:

GDP

Gross Domestic Product, which is the total value of all goods and services produced within a country's borders in a specific time period.

Households

Economic units consisting of all persons who occupy a dwelling, which make decisions on consumption, savings, and investments.

Firms

Business organizations that use resources to produce goods or services for sale with the aim of making a profit.

Transfer Payments

Payments made by the government to individuals, without any expectation of a direct return or exchange of goods or services.

Q20: Information needed to compute a depletion charge

Q23: On April 30,2014,Brother,Inc.purchased for $30 per share

Q30: Which of the following is true?<br>A)Companies can

Q70: What is the accounting principle underlying the

Q77: From the following information,determine the amount of

Q79: Which of the following temporary differences ordinarily

Q85: Ballantine Products,Inc.,reported an excess of warranty expense

Q86: The general ledger of the Flybird Corporation

Q94: The claim is sometimes made that the

Q109: An overstatement of ending inventory in Period