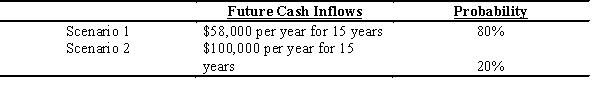

Python Mining Company has a copper mine in Nevada operating at a reduced level of production for the past two years.The market for copper has been adversely affected by weak prices,low demand,and foreign competition.Management believes that the market likely will improve next year and does not plan to abandon this facility.Nevertheless,the controller of the company plans to test the plant and equipment of the operation for impairment due to the decrease in its use.The plant and equipment used in this operation were acquired five years ago for $1,600,000 and have been depreciated using straight-line depreciation over a 20-year life with no residual value.The controller estimates that the assets have a remaining useful life of 15 years and that the following two cash flow scenarios are possible,with the indicated probabilities:

The fair value of the plant and equipment is estimated to be $890,000.

Prepare the entry (if any)required to recognize the impairment loss.

Definitions:

Additional Item

A supplementary product or service added to an existing order or purchase.

Opportunity Cost

The cost of forgoing the next best alternative when making a decision, representing the benefits one misses out on when choosing one option over another.

Car Dealership Union

A labor union representing workers within car dealerships.

Salesmen's Salaries

The compensation provided to sales professionals, usually comprising a base salary and potentially including commissions or bonuses tied to performance.

Q19: Accrued interest on bonds that are sold

Q26: Oriole Industries computed a pretax financial income

Q29: Governor Corporation entered into a direct financing

Q37: Bank reconciliations are normally prepared on a

Q54: If the bonds were issued on April

Q77: From the following information,determine the amount of

Q83: Seymour Associates computed a pretax financial income

Q84: During the year,The Mound Company purchased $1,920,000

Q96: Ominous Studios,in an effort to promote the

Q120: The gross profit method of estimating inventory