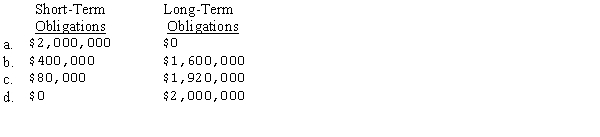

Conrad,Inc.has $2,000,000 of notes payable due June 15,2015.At the financial statement date of December 31,2014,Conrad signed an agreement to borrow up to $2,000,000 to refinance the notes payable on a long-term basis.The financing agreement called for borrowings not to exceed 80 percent of the value of the collateral Conrad was providing.At the date of issue of the December 31,2014,financial statements,the value of the collateral was $2,400,000 and was not expected to fall below this amount during 2015.In its December 31,2014,balance sheet,Conrad should classify notes payable as

Definitions:

Corporate Bond

A type of debt security issued by corporations to raise capital, promising to pay back the face value plus interest.

Coupon Rate

The interest rate stipulated on a bond’s certificate, paid to its holder at specified intervals until maturity.

Yield To Maturity

The total return anticipated on a bond if it is held until the end of its lifetime, accounting for interest payments and price changes.

Modified Duration

A formula that predicts the change in a bond's price for a 1% change in interest rates, considering the bond's yield to maturity.

Q4: Selected information from the 2011 and 2010

Q7: The data below are from the December

Q27: Footnote disclosures for long-term liabilities provide information

Q36: Five years ago,Monroe,Inc.,purchased a patent for $110,000.Lower

Q39: Lawson Corporation's checkbook balance on December 31,2014,was

Q62: Which securities are purchased with the intent

Q65: On January 1,2014,Reds Corporation adopted a defined

Q73: Samuels Company began operations on January 1,2014,and

Q79: Franklyn Publishing Company is marketing a new

Q129: A markup of 25 percent on cost