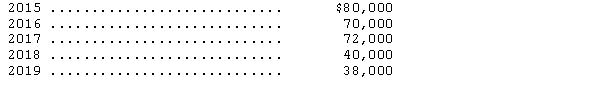

Analysis of the assets and liabilities of Baxter Corp.on December 31,2014,disclosed assets with a tax basis of $1,000,000 and a book basis of $1,300,000.There was no difference in the liability basis.The difference in asset basis arose from temporary differences that would reverse in the following years:

The enacted tax rates are 30 percent for the years 2014-2017 and 35 percent for 2018-2019.The total deferred tax liability on December 31,2014,should be

Definitions:

Increased Grievance

Describes a situation where there is a rise in complaints or dissatisfaction, often within an organizational or social setting.

Technological Advancement

The process of developing new technologies and improving existing ones to enhance productivity, efficiency, and quality of life.

Labor Force

Refers to the total number of people available to work, including both the employed and those seeking employment.

Unique Risks

Specific threats or vulnerabilities that are distinct to an individual, organization, project, or activity.

Q3: The foreign currency translation adjustments amount is

Q11: In computing the change in deferred tax

Q16: Complete the following statement by choosing the

Q26: Soundesign Company entered into a lease of

Q54: Stern Fitness Enterprises uses soybeans to make

Q60: Which of the following is NOT classified

Q65: Moreland Corporation issued $200,000 of 10-year bonds

Q70: In January 2014,Albert Corporation acquired 20 percent

Q97: Which of the following shareholder rights is

Q104: The annual interest expense on a $50,000,15-year,10