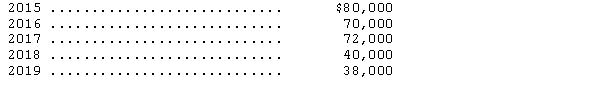

Analysis of the assets and liabilities of Baxter Corp.on December 31,2014,disclosed assets with a tax basis of $1,000,000 and a book basis of $1,300,000.There was no difference in the liability basis.The difference in asset basis arose from temporary differences that would reverse in the following years:

The enacted tax rates are 30 percent for the years 2014-2017 and 35 percent for 2018-2019.The total deferred tax liability on December 31,2014,should be

Definitions:

Night Shift Work

Employment involving working hours that occur during the night, often affecting sleep patterns and health.

Rotate Shifts

A work schedule system where employees alternate working hours, often used to cover 24-hour operations without overburdening individual workers.

Bright Lights

Intense or highly illuminated lighting conditions, often used for visibility or in therapy to treat certain medical conditions.

Congestive Heart Failure

A condition where the heart's ability to pump blood is inadequate, causing fluid buildup in the body.

Q5: Vinny,Inc.has an incentive compensation plan under which

Q9: In 2014,Ryan Corporation reported $85,000 net income

Q12: Rowan Corporation,a calendar-year firm,is authorized to issue

Q18: Which of the following statements concerning guaranteed

Q19: An investor that uses the equity method

Q37: Sanders Company began business in February of

Q39: When computing earnings per share on common

Q67: Ideally,managers should make accounting changes only as

Q73: When a company issues bonds,how are unamortized

Q83: Witherfork Company was recently acquired by a