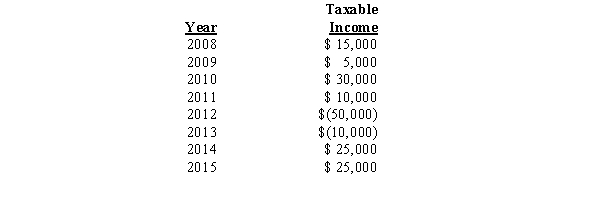

The data shown below represent the complete taxable income history for Confederacy Corporation.The tax rate was 35% throughout the entire period 2008 through 2015:

If the company always chooses the carryback,carryforward option,what is the tax liability for 2014?

Definitions:

Temporary Use

The limited-time utilization of an asset or service for a specific period or purpose.

Personal Purpose

A motive or intention that serves an individual's own interests or desires, often distinct from business or professional objectives.

Goods Contract

A legally binding agreement concerning the sale, purchase, or lease of physical items or products.

Services Contract

An agreement between parties where one agrees to provide a specified service to the other in exchange for compensation.

Q13: Under international accounting standards,cash paid for dividends

Q16: Sanborn,Inc.,leased equipment from Chase Supply on December

Q21: On December 27,2014,Admission Company ordered merchandise for

Q36: An example of an item that should

Q46: Overland,Inc.had 150,000 shares of common stock issued

Q48: Zenith Corporation bought a machine on January

Q49: Winters,Inc.,pays its managers a bonus consisting of

Q57: Which of the following is correct regarding

Q65: On a statement of cash flows prepared

Q70: Which choice best describes the information that