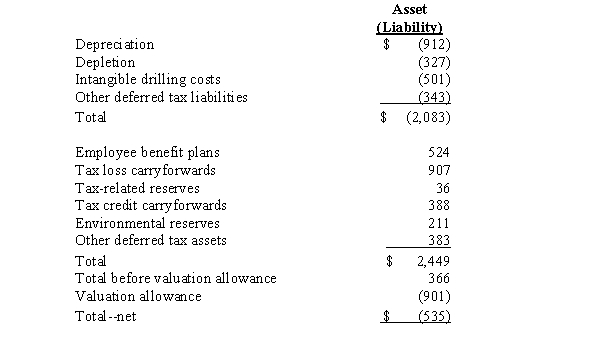

The notes to the 2014 financial statements of Halvoline Oil Company provide the following disclosure regarding the deferred tax asset and liability accounts at December 31,2014 (amounts in millions of dollars):

Required:

1.What is the total amount of deferred liability at December 31,2014? What is the total amount of deferred tax asset? What is the net amount of the deferred tax asset or liability?

2.Assuming a federal tax rate of 35 percent,estimate the temporary difference arising from depreciation that exists for Halvoline at December 31,2014.

3.On December 31,2014,Halvoline shows a noncurrent liability on its balance sheet,captioned "deferred income taxes",in the amount of $634 million.What other deferred tax account,if any is included in the balance sheet? What is the amount of this other deferred tax account?

Definitions:

Organizations

Groups structured and managed to meet a need or to pursue collective goals on a continuing basis.

Six Sigma

A data-driven approach and methodology for eliminating defects in any process, from manufacturing to transactional and from product to service.

Corporate Culture

The shared values, beliefs, and practices that shape the social and psychological environment of a business organization.

Performance Management

A strategic approach focused on improving and maintaining employee performance to achieve organizational goals.

Q25: Which of the following is true regarding

Q26: Ginza Enterprises,a subsidiary of Universal Enterprises based

Q33: On January 1,2014,Benjamin Industries leased equipment on

Q44: Which of the following is true of

Q46: A company's income statement disclosed $45,000 of

Q55: On April 1,2014,Ziba Inc.purchased as a temporary

Q64: Ibarra Carpet traded cleaning equipment with a

Q70: The asset-liability method of interperiod tax allocation

Q73: Chiclet Company decides at the beginning of

Q105: On December 31,2013,National Refining Company purchased machinery