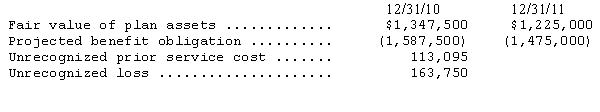

Feinberg,Inc.,provides a noncontributory defined benefit plan for its 200 employees.Information from the company's pension footnote for the year ended December 31,2013,and partial information for the year ended December 31,2014,are given below:

The company's actuary indicated that the settlement rate and expected rate of return on plan assets were both 8% for 2013 and 2014.The company contributed $221,250 to the plan at the end of 2014.Service cost for 2014 was $125,000.

On January 1,2013,the company amended its plan to grant retroactive credit for prior service rendered by employees prior to the amendment.This amendment increased unrecognized prior service cost by $125,000 at that date.The prior service cost is being amortized over the average remaining service life of the employees affected by the amendment.The average remaining service life of the workforce in each year has been constant at 10.5 years.

(1)Prepare a schedule computing pension cost for 2014.

(2)Prepare the journal entries to record pension expense and the pension contribution,and to recognize the correct minimum liability,if any.

(3)Prepare the reconciliation between the beginning and ending balances of the projected benefit obligation as required by GAAP for the disclosures related to pension plans.

Definitions:

Blank Slide

An empty slide in presentation software that can be customized with text, images, and other content.

Screen Resolution

The number of distinct pixels that can be displayed in each dimension on a display screen.

Windows

An operating system developed by Microsoft that provides a graphical interface for managing files, running software, and performing other computer tasks.

Scroll Bar

A graphical control element used to navigate vertically or horizontally through a portion of a document or website that is not visible on the screen.

Q19: Using the information above,the 1,000 shares of

Q37: Using the information above,what is the number

Q42: On February 1,2014,Andover Inc.had excess cash on

Q49: If the lessee and the lessor use

Q55: A company with substantial operating profits prepares

Q56: On December 31,2014,Endive Company leased a machine

Q63: When preparing a reconciliation of net income

Q72: On August 1,2014,B.Amherst Company reacquired 4,000 shares

Q73: If the residual value of a leased

Q79: Which of the following components should be