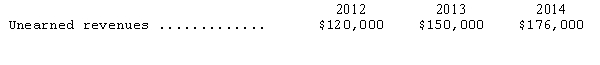

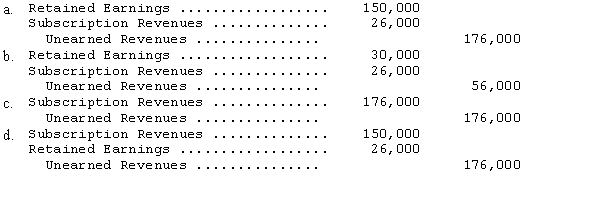

Pages,Inc.receives subscription payments for annual (one year)subscriptions to its magazine.Payments are recorded as revenue when received.Amounts received but unearned at the end of each of the last three years are shown below.

Pages failed to record the unearned revenues in each of the three years.The entry needed to correct the above errors is

Definitions:

Winding-Up Process

The formal process of dissolving a company, involving the liquidation of assets, paying off creditors, and distributing any remaining assets to shareholders.

Partnership Assets

Assets or property owned by a partnership entity, which are used for conducting its business activities.

Limited Liability

A legal principle that protects shareholders from being personally responsible for more than their investment in a corporation.

LLC

A Limited Liability Company (LLC) is a business structure in the United States that protects its owners from personal responsibility for its debts or liabilities.

Q1: Using the effective-interest method of amortization,interest expense

Q2: Eva Designs,Inc.,a corporation organized on January 1,2005,reported

Q21: The U.S.tax law provides incentives for companies

Q27: On March 1,Suki Corporation entered into a

Q28: Which of the following is NOT a

Q35: Blind Faith Company reported the following data

Q50: Avionics Inc.,a dealer in machinery and equipment,leased

Q59: Panther Company does not want to bear

Q133: Delta Company acquired land and a building

Q176: Cola, Inc., issued a 12-year, 10%, $1,500,000