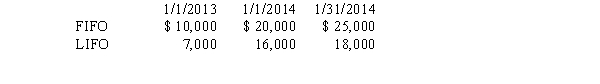

A retailing firm changed from LIFO to FIFO in 2014. Inventory valuations for the two methods appear below:

Purchases in 2013 and 2014 were $60,000 in each year.

Purchases in 2013 and 2014 were $60,000 in each year.

-Using the information above,in the comparative 2013 and 2014 income statements,what amounts would be shown for cost of goods sold?

Definitions:

Production Units

The quantity of items or goods produced during a specific period, serving as a measure of a company's manufacturing activity.

Sales Budget

A detailed outline of a company's sales expectations for a certain period, including projected revenue and the resources needed to achieve those sales.

Inventory Policy

Guidelines and strategies a company employs to manage its inventory levels, ordering processes, and storage to balance customer demand with optimal inventory costs.

Production Units

Measures or quantities of product manufactured or processed in a given time frame.

Q3: The foreign currency translation adjustments amount is

Q16: Which of the following is a non-cash

Q23: Modesto,Inc.leased machinery with a fair value of

Q27: Simple interest is more frequently used than

Q38: Jacquin Corporation reports its income from investments

Q41: The _ is calculated by dividing total

Q53: Under international accounting standards,remote contingent liabilities are<br>A)not

Q58: The following segments were identified for an

Q64: At the beginning of the year,a firm

Q94: Under the effective-interest method of amortizing bond