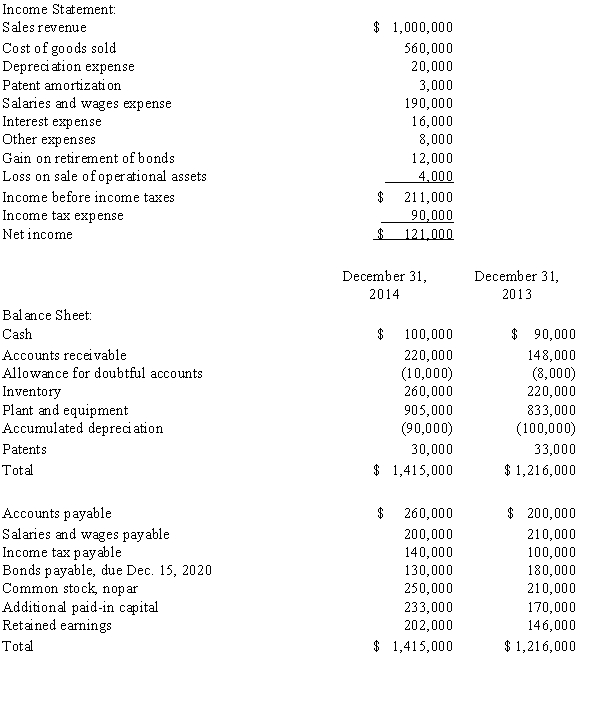

The following information for Amphora Company is available at December 31,2014,and for the year then ending:

The following information is available for specific accounts and transactions:

1.On February 2,2014,Amphora issued a 10 percent stock dividend to shareholders of record on January 15,2014.Market price per share of the common stock on February 2,2014,was $15.

2.On March 1,2014,Amphora issued 3,800 shares of common stock for land.The common stock had a current market value of approximately $40,000 on March 1,2014.

3.On April 15,2014,Amphora repurchased its long-term bonds payable with a face value of $50,000 for cash.

4.On June 30,2014,Amphora sold for $19,000 cash equipment having a book value of $23,000 and an original cost of $53,000.

5.On September 30,2014,Amphora declared and paid a 4 cent per share cash dividend to shareholders of record on August 1,2014.

6.On October 1,2014,Amphora purchased land for $85,000 cash.

Required:

Prepare a statement of cash flows for Amphora Company for the year ending December 31,2014,using the indirect method.

Definitions:

Encrypted

Refers to data that has been converted into a secure format that prevents unauthorized access, typically through the use of algorithms and cryptographic keys.

Command-line Option

An instruction or parameter specified in the command line interface to control the behavior of a program.

Startup Option

A setting that determines how a software application behaves or launches upon the system's start or the application's initiation.

Exclusive Mode

A mode where a software application or system restricts access to a particular resource or set of resources to a single user or process.

Q1: On November 1,2014,Balloon Company sold some limited

Q10: Useful Organizing began operations on January 1,20X3,when

Q25: During a recent two-week period,the employees of

Q44: Which of the following statements is TRUE?<br>A)For

Q50: Which of the following,if discovered by Somber

Q50: Which of the following items results in

Q76: Digistore,Inc.,had 400,000 shares of $20 par common

Q108: Machiel Manufacturing acquired a $60,000 machine on

Q113: A recoverability test for impairment<br>A)is based on

Q148: Double-declining-balance depreciation may be referred to as