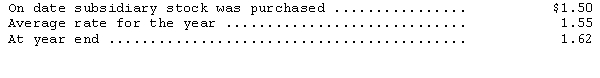

Florence Enterprises,a subsidiary of Verona Company based in New York,reported the following information at the end of its first year of operations (all in euros) : assets--1,320,000; expenses--340,000; liabilities--880,000; capital stock--80,000,revenues--400,000.Relevant exchange rates are as follows:

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Book Value

The value of an asset as it appears on a balance sheet, calculated by subtracting any associated depreciation or amortization from its original cost.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset since it was put into service, reducing its book value on the balance sheet.

Machinery

Equipment or devices that perform specific tasks, often used in production and manufacturing processes.

Cash

A form of currency that includes coins and paper notes, used as a medium of exchange for goods and services.

Q9: Which combination is the correct statement regarding

Q37: Under international accounting standards,which of the following

Q57: Which of the following transactions would increase

Q59: Panther Company does not want to bear

Q63: On January 1,2014,Suppose Company paid property taxes

Q71: The if-converted method of computing EPS data

Q83: Permanent differences between income tax per GAAP

Q132: Milton Manufacturing manufactures and sells ornamental statues.Because

Q137: At the beginning of 20X3,Shingles Roofing had

Q178: The U.S.tax law provides incentives for companies