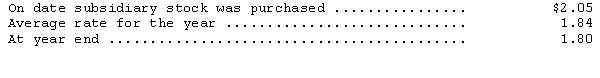

Windsor Enterprises,a subsidiary of Kennedy Company based in New York,reported the following information at the end of its first year of operations (all in British pounds) : assets--338,000; expenses--360,000; liabilities--101,000; capital stock--80;000,revenues--517,000.Relevant exchange rates are as follows:

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Dependence

The state of relying on or being controlled by someone or something else, often seen in healthcare relating to patients’ reliance on caregivers or medical professionals.

Independence

The state or condition of being free from dependence, control, or influence of others, often associated with self-sufficiency and autonomy.

Nurse-patient Relationship

The dynamic and therapeutic connection established between a nurse and a patient to support healing and promote health.

Forchuk's Research

A body of research led by Cheryl Forchuk, focusing on mental health, nursing practices, and the integration of technology in healthcare.

Q27: SFAS No.109 allows the recognition of deferred

Q36: An example of an item that should

Q46: For each of the following

Q48: The inventory turnover ratio<br>A)measures management's ability to

Q54: Using the information above,choose the following:<br>1.The correct

Q64: Which of the following would NOT be

Q72: Which type of contract is unique in

Q121: On January 1,2009,First Bank acquired 10 cars

Q126: The cost of equipment shall include all

Q173: Companies that have a poor credit rating