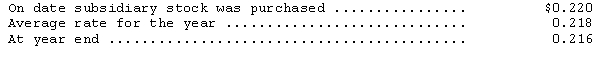

DeGaulle Enterprises,a subsidiary of Clinton Company based in New York,reported the following information at the end of its first year of operations (all in French francs) : assets--4,790,000; expenses--6,500,000; liabilities--2,950,000; capital stock--1,200,000,revenues--7,140,000.Relevant exchange rates are as follows:

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Carrying Value

The net amount at which an asset or liability is valued on the balance sheet, also known as book value, factoring in depreciation, impairments, and amortization.

Fair Value Hedge

A hedge that is used to mitigate the risk of changes in the fair value of an asset or liability or an unidentified portion of such an asset or liability.

Fair Market Value

An estimate of the market value of a property, based on what a knowledgeable, willing, and unpressured buyer would likely pay to a knowledgeable, willing, and unpressured seller in the market.

Interest Rate Swap

A financial derivative contract whereby two parties exchange interest rate cash flows, often swapping a fixed rate for a floating rate, or vice versa, to manage exposure to interest rate fluctuations.

Q9: Which of the following statements characterizes defined

Q16: Compatibility Services acquired an $80,000 machine on

Q23: Aboard Company began the current year with

Q34: On June 18,Burger Corporation entered into a

Q48: On December 31,2014,Luanne Inc.had outstanding 180,000 shares

Q58: Allsgood Appliances computed a pretax financial loss

Q75: On December 31,2013,Freulein Company had 8,000 shares

Q86: Gains on disposal of plant assets are

Q120: A goodwill write-off is a noncash expense.

Q166: Which statement is false?<br>A)The periodic interest payment