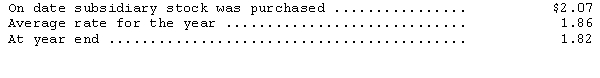

Monty Enterprises,a subsidiary of Kerry Company based in Delaware,reported the following information at the end of its first year of operations (all in British pounds) : assets--483,000; expenses--360,000; liabilities--105,000; capital stock--90,000,revenues--648,000.Relevant exchange rates are as follows:

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Production Possibilities Curves

A graphical representation that shows the maximum possible output combinations of two goods or services an economy can produce given its available resources and technology.

Comparative Advantage

The proficiency of either a person, a company, or a country in crafting a good or providing a service, which comes at a lesser opportunity cost than that offered by rival parties.

Domestic Demand

The total demand for goods and services within a country's borders.

Q10: Cash inflows from investing activities would include

Q13: Employers use a discount rate to compute

Q30: Which earnings per share computation should be

Q48: On December 31,2014,Luanne Inc.had outstanding 180,000 shares

Q52: Which of the following is the primary

Q73: Dugger Excavating bought a machine for $24,000

Q102: Expenditures are purchases of goods or services,whether

Q151: The excess of a bond's issue price

Q165: Gambet Labs entered into a lease

Q169: Which of the following is false? The