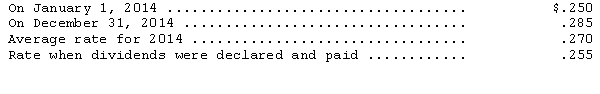

Hosgood Distributing Inc.converts its foreign subsidiary financial statements using the translation process.Their German subsidiary reported the following for 2014: revenues and expenses of 9,050,000 and 6,400,000 marks,respectively,earned or incurred evenly throughout the year,dividends of 2,000,000 marks were paid during the year.The following exchange rates are available:

Translated net income for 2014 is

Definitions:

Product Cost

The total cost associated with making or acquiring a product, including materials, labor, and overhead.

Depreciation

The accounting method of allocating the cost of a tangible or physical asset over its useful life to account for declines in value.

Activity Increases

Situations in which the level or intensity of a specific action or operations grows or intensifies.

Discretionary Fixed Costs

Those fixed costs that arise from annual decisions by management to spend on certain fixed cost items, such as advertising and research.

Q11: Assume a company had net income of

Q17: During its fiscal year,Deerborn Distributing had net

Q23: Which of the following is correct regarding

Q37: Under international accounting standards,which of the following

Q45: Statement of Financial Accounting Standards No.128,"Earnings Per

Q54: A translation adjustment resulting from the translation

Q59: On January 1,2009,Amanda Mackenzie purchased a

Q61: Which of the following ratios measures short-term

Q62: Employees of Mayhem Fabricators,Inc.earned gross wages of

Q112: Simple interest is calculated by multiplying an