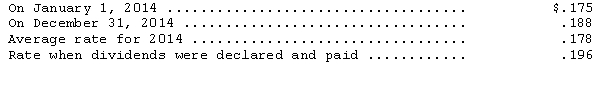

Global Trading Company.converts its foreign subsidiary financial statements using the translation process.The company's Swiss subsidiary reported the following for 2014: revenues and expenses of 13,220,000 and 6,672,000 Swiss francs,respectively,earned or incurred evenly throughout the year,dividends of 2,000,000 Swiss francs were paid during the year.The following exchange rates are available:

Translated net income for 2014 is

Definitions:

Interest Paid

The amount of money paid by a borrower to a lender in return for the use of borrowed funds, calculated as a percentage of the loan amount.

Dividends Paid

Distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders.

Cost of Sales

Direct costs attributable to the production of the goods sold by a company, including material and labor costs.

Inventories

The complete list of items such as property, goods in stock, or the contents of a building.

Q3: For purposes of computing the weighted-average number

Q4: An investor purchasing bonds between interest dates

Q26: Records for the Bass Corporation's defined-benefit pension

Q58: Income tax withholdings and Social Security withholdings

Q65: A contingent liability is a liability that

Q68: On January 1,2011,Shine Services Inc.purchased a new

Q69: Using the information above and assuming the

Q84: Binary Controls Inc.had 250,000 shares of common

Q92: Most companies use accelerated depreciation for financial

Q129: Compatibility Services acquired an $80,000 machine on