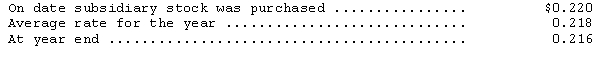

DeGaulle Enterprises,a subsidiary of Clinton Company based in New York,reported the following information at the end of its first year of operations (all in French francs) : assets--4,790,000; expenses--6,500,000; liabilities--2,950,000; capital stock--1,200,000,revenues--7,140,000.Relevant exchange rates are as follows:

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Grant Reid

An executive known for his leadership role as CEO of Mars, Incorporated, focusing on the company's growth and sustainability initiatives.

Right Expertise

denotes possessing the correct or most suitable knowledge and skills for a particular task or situation.

Communication Competency

The ability to effectively convey, receive, and interpret messages and information through various modes of communication.

Computer-based Resources

Digital tools, programs, and platforms available on computers that support information processing, learning, and task execution.

Q18: A loss will result on the sale

Q19: What is measured by the accumulated benefit

Q23: Treating a capital expenditure as repairs and

Q25: If all temporary differences entering into the

Q63: An entity changed from the FIFO to

Q65: Which statement is FALSE?<br>A)The economic life of

Q67: Uncertainty about the future market value of

Q67: Creative Corporation's income statement for the year

Q83: One component of net pension expense,unrecognized gains

Q173: Companies that have a poor credit rating