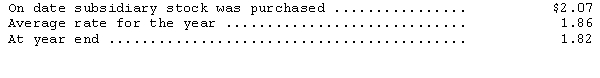

Monty Enterprises,a subsidiary of Kerry Company based in Delaware,reported the following information at the end of its first year of operations (all in British pounds) : assets--483,000; expenses--360,000; liabilities--105,000; capital stock--90,000,revenues--648,000.Relevant exchange rates are as follows:

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Painted Surfaces

Any material or object coated with pigment or paint, often for protective or aesthetic purposes.

Exemption Clause

A contractual term that limits or excludes one party's liability for certain breaches or situations.

Sale of Goods Act

Legislation governing the sale of goods, providing rights to buyers and obligations to sellers, focusing on elements like product conformity and transactional fairness.

Fundamental Breach

A breach of a fundamental aspect of the contract that is not covered by an exclusion clause; a breach that goes to the very root of the contract.

Q5: Under international accounting standards,the standard for accounting

Q7: Badger Corporation purchased a machine for $132,000

Q35: Hibachi,Inc.,purchased Wasabi Manufacturing Company,a Japanese company,on January

Q53: Concourse Corporation paid $20,000 in January of

Q60: The following information is available from the

Q68: At December 31,2013,Grandin Corporation had 500 shares

Q71: Tongass had pretax accounting income of $1,400

Q74: Which statement is true regarding zero coupon

Q77: A company's portion of long-term debt that

Q102: The market or effective rate of interest