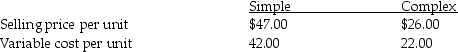

Watson Corporation manufactures two products,Simple and Complex.The following annual information was gathered:  Total annual fixed costs are $18,000.Assume Watson Corporation can produce and sell any mix of Simple or Complex at full capacity.It takes one hour to make one unit of Complex.However,Simple takes 50% longer to manufacture when compared to Complex.Only 120,000 hours of plant capacity are available.How many units of Simple and Complex should Watson Corporation produce and sell in a year to maximize profits?

Total annual fixed costs are $18,000.Assume Watson Corporation can produce and sell any mix of Simple or Complex at full capacity.It takes one hour to make one unit of Complex.However,Simple takes 50% longer to manufacture when compared to Complex.Only 120,000 hours of plant capacity are available.How many units of Simple and Complex should Watson Corporation produce and sell in a year to maximize profits?

Definitions:

Comprehensive Income

Comprehensive income includes all changes in equity during a period except those resulting from investments by owners and distributions to owners.

GAAP

Generally Accepted Accounting Principles, a set of accounting standards and procedures used in the United States to prepare and present financial statements in a consistent manner.

Financial Statements

Comprehensive reports that provide information about a company's financial performance and position, including its income statement, balance sheet, statement of cash flows, and statement of shareholder equity.

Other Comprehensive Income

A financial accounting term representing the revenues, expenses, gains, and losses that are not included in net income, affecting the equity section of the balance sheet outside of net income.

Q10: Managers may use different markup rates for

Q28: A disadvantage of the visual-fit method to

Q33: The following sales budget has been prepared:

Q43: A flexible budget adjusts for changes in

Q65: Companies use cost-plus pricing for products where

Q72: Which of the following is NOT a

Q86: Accountants are sometimes forced to trade relevant

Q87: Yesterday Company used regression analysis to predict

Q90: "Cooking the books" refers to recording fictitious

Q107: Unallocated costs _.<br>A)are not recorded in the