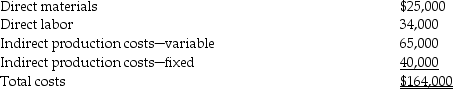

Jeff Company produces a part that is used in the manufacture of one of its products.The annual costs associated with the production of 11,000 units of this part are as follows:

A supplier is willing to sell 11,000 units of the part to Jeff Company for $12.50 per unit.When examining the indirect production costsfixed,Jeff Company determines $10,000 is avoidable.

A supplier is willing to sell 11,000 units of the part to Jeff Company for $12.50 per unit.When examining the indirect production costsfixed,Jeff Company determines $10,000 is avoidable.

Required:

A)If there are no alternative uses for the facilities,should Jeff Company take advantage of the supplier's offer?

B)If Jeff Company decides to buy the part from the supplier,Jeff Company can rent out the idle facilities for $50,000 per year.Should Jeff Company take advantage of the supplier's offer?

Definitions:

Current Performance

The present level of achievement or output in a particular area or activity.

World-Class Companies

Businesses that are leaders in their respective industries or sectors, demonstrating excellence in quality, performance, and competitiveness on a global scale.

ISO Certification

A seal of approval from the International Organization for Standardization that indicates a company meets a set of defined standards for quality, safety, and efficiency.

Competitive Advantage

The attribute that allows an organization to outperform its rivals.

Q15: Nestle Company paid $130,000 for a machine

Q46: Palmer Inc.currently produces 110,000 units at a

Q60: Jaggers Company has the following data: <img

Q62: Selecting a volume-related cost driver and classifying

Q74: Imprecise but relevant information can be useful.

Q84: Decreasing cycle time often results in bringing

Q106: Twilight Company has the following information: <img

Q112: Only major changes in the scale or

Q116: Round Company currently produces cardboard boxes in

Q118: _ costs provide evidence about a manager's