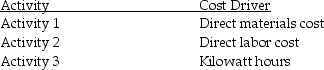

The manufacturing division of an electronics company uses activity-based costing.The company has identified three activities and the related cost drivers for indirect production costs.

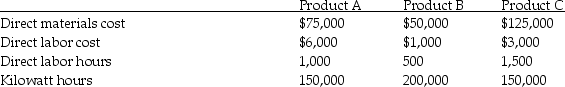

Three types of products are produced.Direct costs and cost-driver activity for each product for a month are as follows:

Three types of products are produced.Direct costs and cost-driver activity for each product for a month are as follows:

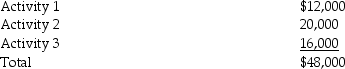

Indirect production costs for the month are as follows:

Indirect production costs for the month are as follows:

Required:

Required:

A)Compute the indirect production costs allocated to each product using the ABC system.

B)Compute the indirect production costs allocated to each product using a traditional costing system.Assume indirect production costs are allocated to each product using the cost driver: direct labor hours.

Definitions:

Incremental Cash Flows

The additional cash flow a company receives from taking on a new project or investment, after accounting for expenses.

Q6: Rocky Company acquired 40% of the voting

Q7: Under the equity method of accounting for

Q12: Discretionary fixed costs have direct relationships with

Q16: A cash budget is a business plan

Q31: Line operating managers usually prepare and use

Q45: The Investment in Subsidiary account appears on

Q52: In imperfect competition,a firm must increase the

Q52: An unallocated cost of one company may

Q53: In a merchandising firm,the computation of Cost

Q117: The balance sheet for Lewis Company at