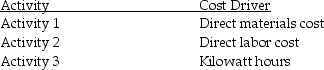

The manufacturing division of an electronics company uses activity-based costing.The company has identified three activities and the related cost drivers for indirect production costs.

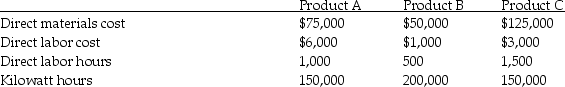

Three types of products are produced.Direct costs and cost-driver activity for each product for a month are as follows:

Three types of products are produced.Direct costs and cost-driver activity for each product for a month are as follows:

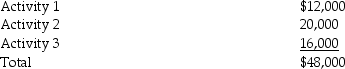

Indirect production costs for the month are as follows:

Indirect production costs for the month are as follows:

Required:

Required:

A)Compute the indirect production costs allocated to each product using the ABC system.

B)Compute the indirect production costs allocated to each product using a traditional costing system.Assume indirect production costs are allocated to each product using the cost driver: direct labor hours.

Definitions:

Money Income

The total earning received by an individual or household including wages, salaries, and other forms of income, before any deductions.

Marginal Utility

The extra pleasure or advantage gained from consuming an additional unit of a product or service.

Total Utility

The complete satisfaction or pleasure a consumer derives from consuming a particular quantity of goods or services.

Budget Line

A graphical representation of all possible combinations of two goods that can be purchased with a given budget and prices.

Q19: The contribution approach to the income statement

Q19: The fixed costs required to achieve a

Q39: When managers graph a linear cost function

Q43: Customers and company activities are examples of

Q60: Book value is defined as _.<br>A)disposal value<br>B)disposal

Q67: What happens when the cost-driver activity level

Q80: An example of a strategic management decision

Q81: On January 1,2012,a parent company acquired all

Q86: The CVP graph shows profit and loss

Q101: Nebraska Company produces and sells 20,000 units