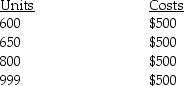

The following three data points are available.This is an example of a ________ cost.

Definitions:

Beta

A measure of the volatility, or systemic risk, of a security or a portfolio in comparison to the market as a whole; it indicates the tendency of a security's returns to respond to swings in the market.

CAPM (Capital Asset Pricing Model)

A model used to determine the expected return on an investment based on its level of risk, as well as the risk-free rate of return and the expected market return.

Risk Premium

The extra return expected by an investor for holding a risky asset compared to a risk-free asset, as compensation for the higher risk.

Diversifiable Risk

A type of risk that can be reduced or eliminated from a portfolio by holding a variety of investments.

Q5: The key to determining the financial difference

Q11: Crispy Company manufactures a part for its

Q12: HugME Company produces dolls.Each doll sells for

Q12: Allocated costs are irrelevant for most decisions

Q34: Which of the following statements about the

Q48: Pease Company's expected sales for April are

Q75: Jack Bowers has paid off the mortgage

Q97: The profitability of a given product guides

Q126: What happens when the cost-driver activity level

Q139: When examining the output from regression analysis,the