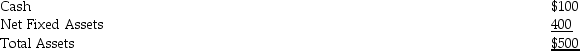

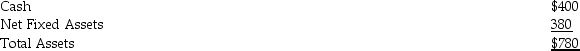

Presented below is the balance sheet of Hal Company at January 1,2015:

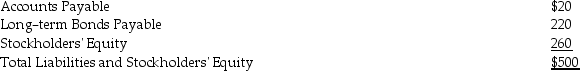

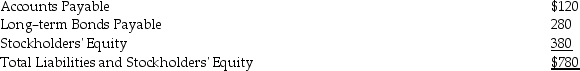

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.The net income for the year ending December 31,2015 was $30 for Hal Company.The net income for the year ending December 31,2015 was $40 for Monty Company.There were no intercompany sales.What is the net income on the consolidated income statement for the year ended December 31,2015?

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.The net income for the year ending December 31,2015 was $30 for Hal Company.The net income for the year ending December 31,2015 was $40 for Monty Company.There were no intercompany sales.What is the net income on the consolidated income statement for the year ended December 31,2015?

Definitions:

Stock Dividend

A dividend payment made in the form of additional shares rather than cash, reflecting a company's desire to reinvest its profits.

Outstanding Shares

The total number of shares of stock that are currently owned by investors, including restricted shares owned by the company’s officers and insiders.

Distribution

The process of delivering products from the production or service facility to the end user, including storage, transportation, and logistics.

Stock Split

A corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares.

Q1: SLOW Company has determined the following information

Q5: The liabilities of Sam Company are listed

Q26: The income statement and comparative balance sheets

Q30: The cost of using the telephone,which involves

Q54: A company uses job-order costing.At the end

Q77: What type of users need detailed cost

Q88: A disadvantage of the LIFO method is

Q90: The balances on December 31,2015 are available

Q95: Variable costs _.<br>A)vary per unit<br>B)are fixed in

Q112: Presented below is the balance sheet of