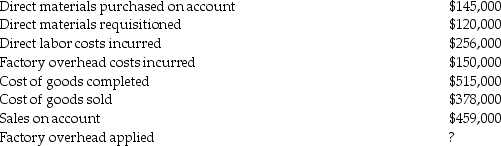

CCC Company uses job-order costing.The following is a summary of factory operations:

Factory overhead costs are applied at 70% of direct labor costs.

Factory overhead costs are applied at 70% of direct labor costs.

Required:

A)Prepare the required journal entries for the above transactions.

B)Prepare the journal entry to dispose of the overhead variance using the immediate write-off method.

Definitions:

Selling Costs

Expenses associated with the marketing and distribution of a product or service.

Transmitter Division

A specialized segment within a company or industry that focuses on the development, manufacturing, or sale of transmitters for various applications.

Outside Supplier

A third-party entity or company that provides goods or services to another company as part of the production process or operational needs.

Maximum Price

The highest price that can be charged for a product or service, often regulated by law or market conditions.

Q10: The liabilities of Becky Company are listed

Q25: Most companies that follow accrual basis accounting

Q27: Samuel Company has two production departments called

Q33: Two conventional ways of allocating joint costs

Q52: Which of the following statements about the

Q55: Brian Company purchased 10% of the outstanding

Q64: A company has the following data available:

Q92: Giants Company had the following information: <img

Q105: What formula should be used to allocate

Q145: Equivalent units are determined by multiplying physical