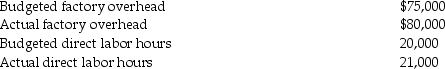

Kings Company had the following information:  Assume the cost driver for factory overhead costs is direct labor hours and a job uses 2,000 direct labor hours.What amount of factory overhead is applied to the job?

Assume the cost driver for factory overhead costs is direct labor hours and a job uses 2,000 direct labor hours.What amount of factory overhead is applied to the job?

Definitions:

Standard Deduction

A fixed amount deducted from income before income tax is calculated, available to all taxpayers who do not itemize their deductions.

Married Couple

Two individuals who are legally married to each other and may file taxes jointly or separately.

Filing Status

A category that defines the type of tax return form an individual or entity will use, based on marital status and other factors.

Adjusted Gross Income (AGI)

A person's entire income before adjustments, reduced by certain allowable deductions, to calculate the income subject to tax.

Q3: The present value of tax savings from

Q6: Increasing capital turnover is one of the

Q12: In job-order costing,time cards record the materials

Q19: The construction and printing industries normally use

Q28: Discounted-cash-flow models are not based on the

Q49: Return on sales equals gross profit divided

Q68: An asset of $180,000 is expected to

Q92: A sale of inventory results in a(n)_

Q124: Ohio Company reported the following information about

Q145: Rent paid in advance would be considered