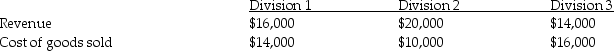

Bears Company has three divisions and allocates central corporate costs of $17,500 to each division based on two different cost drivers that include revenue and cost of goods sold.

Required:

Required:

A)Allocate the central corporate costs to each division using revenue as the cost driver.

B)Allocate the central corporate costs to each division using cost of goods sold as the cost driver.

Definitions:

AASB 141

The Australian Accounting Standards Board's standard on Agriculture, outlining the accounting treatment for agricultural activity.

IAS 41

International Accounting Standard 41, which deals with agriculture, outlining how to account for and report the financial performance and position of agricultural activities.

Biological Transformation

The process by which living organisms convert substances into different forms, such as the conversion of milk into cheese by bacteria.

AASB 141

The Australian Accounting Standards Board statement that outlines the accounting for agricultural activities.

Q9: Which of the following taxes is progressive?<br>A)sales

Q46: Retained earnings are a general claim against

Q58: Decentralization may increase a firm's costs because

Q72: The Internal Revenue Service is the branch

Q90: The phrase "cost distribution" refers to the

Q110: A(n)_ is a review to determine whether

Q112: The accounting rate of return model multiplies

Q124: The step down method of allocating service

Q149: Martin Company's records reveal the following: <img

Q152: EVA uses after-tax numbers for operating income.