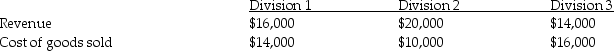

Bears Company has three divisions and allocates central corporate costs of $17,500 to each division based on two different cost drivers that include revenue and cost of goods sold.

Required:

Required:

A)Allocate the central corporate costs to each division using revenue as the cost driver.

B)Allocate the central corporate costs to each division using cost of goods sold as the cost driver.

Definitions:

Voluntary Quota

A self-imposed limit on the quantity of goods a country exports or imports.

Elasticity of Supply

A measure of how much the quantity supplied of a good changes in response to a change in the price of that good.

Price Elasticity

The degree to which the demand for a good is responsive to changes in its price.

Tax Passed

Occurs when the burden of a tax is shifted from the entity legally responsible for it to another party, such as consumers.

Q14: Managers' incentives for performance are defined as

Q15: Variable costing is also called _.<br>A)full costing<br>B)traditional

Q21: Source documents are associated with _.<br>A)Generally Accepted

Q38: Accepting a project with a _ NPV

Q42: Couric Company reported the following information about

Q52: S Corporations result in a single level

Q61: Kirk Company gathered the following information for

Q64: If the internal rate of return on

Q111: In net present value analysis,the minimum desired

Q135: When evaluating an investment project,the higher the