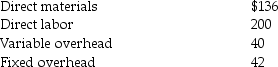

The West and East Divisions are part of the same company.Currently the East Division buys a part from West Division for $384 per unit.The West Division wants to increase the price of the part it sells to East Division by $96 to $480.The manager of the East Division has stated that he cannot pay that much insofar as the division's profit goes below zero.The manager of the East Division can buy the part from an outside supplier for $448 per unit.The cost data pertaining to the part is supplied by the West Division:  If West Division does not produce the parts for the East Division,it will be able to avoid one-third of the fixed manufacturing overhead costs.The West Division has excess capacity but no alternative uses for the facilities.From the standpoint of the company as a whole,should the East Division buy the part from the West Division or the outside supplier?

If West Division does not produce the parts for the East Division,it will be able to avoid one-third of the fixed manufacturing overhead costs.The West Division has excess capacity but no alternative uses for the facilities.From the standpoint of the company as a whole,should the East Division buy the part from the West Division or the outside supplier?

Definitions:

Property Tax

A levy on property that the owner is required to pay, often based on the value of the property.

Excess Burden

The cost to society created by market inefficiency, often associated with government policies like taxes or subsidies.

Tax Shifting

The process by which the economic burden of a tax is passed on from the entity legally responsible for it to another party, often consumers.

Principle of Neutrality

It refers to the economic principle that fiscal policy should not distort market behavior, aiming to maintain a neutral effect on economic choices.

Q5: Sweater Division manufactures sweaters.The buttons used in

Q17: Joint costs are not allocated to a

Q21: Mammoth Company is considering the acquisition of

Q24: Hamada Company has two departments.Relevant information is

Q75: The annual after-tax cash operating inflows of

Q84: Lori had the following income and losses

Q86: Captain Company's records reveal the following: <img

Q96: In 2013 Brett and Lashana (both 50

Q100: _ is (are)the accounting system's effect on

Q109: Which statement is FALSE about performance metrics?<br>A)The