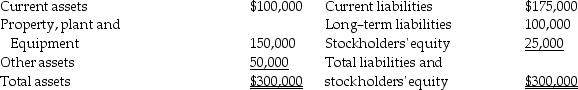

The following information is available for Des Plaines Company:  Invested capital is defined as total assets less current liabilities.The after-tax operating income is $150,000.The after-tax cost of capital is 20%.The before-tax operating income is $200,000.What is the residual income?

Invested capital is defined as total assets less current liabilities.The after-tax operating income is $150,000.The after-tax cost of capital is 20%.The before-tax operating income is $200,000.What is the residual income?

Definitions:

FICA Medicare

FICA Medicare refers to the portion of the Federal Insurance Contributions Act tax that is designated for Medicare, providing health insurance for individuals over 65 and some younger people with disabilities.

Gross Pay

The total amount of money earned by an employee before any deductions or taxes are applied.

Regular Rate

The hourly pay rate that is used to calculate overtime pay for non-exempt employees according to the Fair Labor Standards Act (FLSA).

Excess Hours

Hours worked beyond the normal or scheduled work time, often considered overtime.

Q22: A company is considering two investment projects.If

Q24: Which of the following taxes is proportional?<br>A)gift

Q36: Alexis and Terry have been married five

Q47: In measuring the performance of a division

Q48: Anne Company reports the following information: <img

Q49: The following information pertains to Jupiter Company:

Q61: Hawn Company manufactures two models of pens,a

Q69: In absorption costing,costs are separated into two

Q133: If the IRR on a project is

Q145: Identify the disadvantages of decentralization.