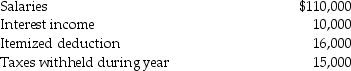

Brad and Angie had the following income and deductions during 2013:

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Definitions:

Brain Malfunctions

Refers to any type of dysfunction or abnormal operation within the brain, impacting its ability to perform its tasks.

Genetics

The science of heredity and variation in living organisms, explaining how traits and characteristics are passed from parents to offspring.

Biology

The examination of life and living entities, focusing on their form, function, development, evolution, and spatial distribution.

Psychological Differences

Variations among individuals in terms of their emotional, cognitive, and behavioral functions and patterns.

Q16: Sarah receives a $15,000 scholarship from City

Q20: Ben,age 67,and Karla,age 58,have two children who

Q26: For federal income tax purposes,income is allocated

Q31: The Institute of Management Accountants has adopted

Q36: The value of health,accident,and disability insurance premiums

Q74: Under the economist's definition,unrealized gains,as well as

Q79: Jacob,who is single,paid educational expenses of $16,000

Q106: Generally,gains resulting from the sale of collectibles

Q120: According to the IMA's Statement of Ethical

Q148: Invested capital can mean any of the